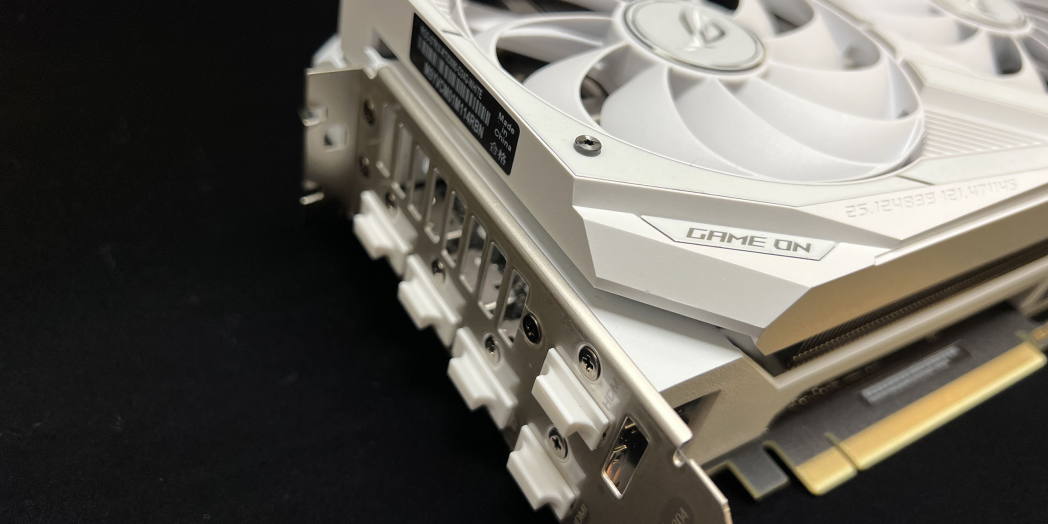

We have now run over 50 miner software tests and have started to gather some experience and statistics that we would like to share!

Last update: 25.January 2023

Through all of our miner software tests, we have learned a lot about how the different miners do the developer fee and how many (most!) miners are over-reporting the hash rate (deviation between pool hash rate and reported hash rate). We will focus on some of the most popular miners for now, and all the numbers you will see in the graphs below have dev fees accounted for!

If you wonder why we are showing the graph for T-Rex 0.24.7 - more about that later!

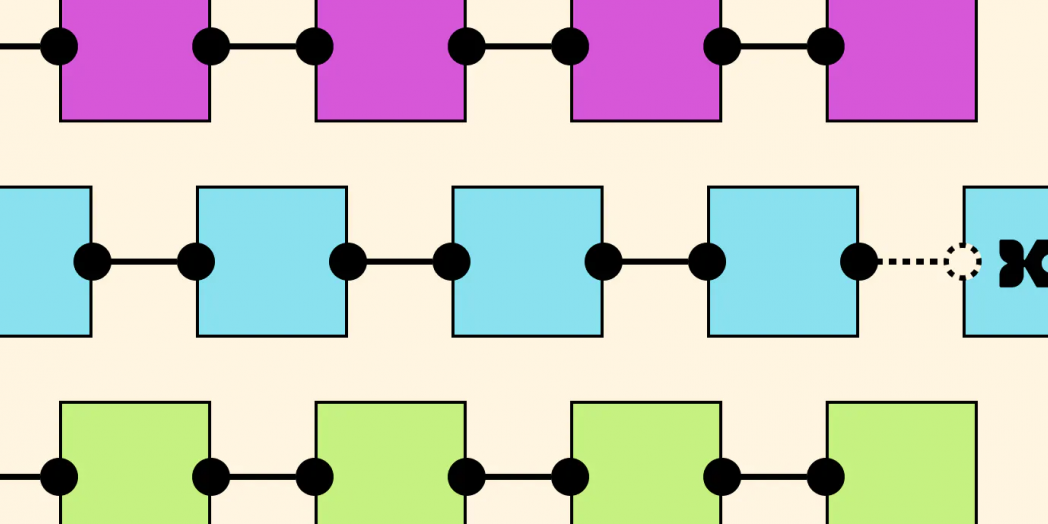

You can also see luck's effect when comparing different runs from the same miner software. When the number of shares is low (the beginning of the runs / left on the graph), luck plays a huge role - and we get considerable variation between the different runs. As the tests run longer and find more and more shares, the chance becomes a much less factor, and the lines are closing in. This is why we run our miner software tests at a minimum of 1.000.000 shares!

Lolliedieb (the developer of lolMiner) describes how the dev fee works in his public telegram channel: Out of 143 kernel calls to the GPU 1 is for me, the others mine your work. So the fee is continuously mined more or less ... you should not be able to recognize the pulsing. If one is over-accurate, the actual price is therefore 0.6993%

We have also learned that NBMiner has had, and also has, some issues when running low diff, so the deviation gets a bit higher than it would be with a more elevated diff pool. We have done a test with 42.2, and the difference between a low diff and a slightly higher diff pool was -0.41 (-1.37% vs -0.96%)

This change in behavior makes the test a bit more complicated to run, as we need to calculate/adjust for the missing fee to get the correct data/numbers we can publish. The graph below shows the time the miner mined the dev fee, comparing an ordinary mining session at Ethermine vs a miner test (low-difficulty pool). This data are collected with T-Rex 0.25.8, but we have seen some behavior from all T-Rex versions from 0.24.8:

Deviation between miners

First, let's compare the deviation between Gminer, lolMiner, Nbminer, TeamRedMiner and Trex:You can also see luck's effect when comparing different runs from the same miner software. When the number of shares is low (the beginning of the runs / left on the graph), luck plays a huge role - and we get considerable variation between the different runs. As the tests run longer and find more and more shares, the chance becomes a much less factor, and the lines are closing in. This is why we run our miner software tests at a minimum of 1.000.000 shares!

Gminer

Taking a look at the graph below, it seems like GMiner are doing continuous fee, so we are not able to recognize the pulsing as we do with miners who stop the current mining and mine for the developer for some time, before resuming the regular mining (See examples below with NBMiner and T-rex)lolMiner

lolMiner also runs a continuous fee, and no fee runs as many other miners do. The straight lines can be this in the graph below:

Lolliedieb (the developer of lolMiner) describes how the dev fee works in his public telegram channel: Out of 143 kernel calls to the GPU 1 is for me, the others mine your work. So the fee is continuously mined more or less ... you should not be able to recognize the pulsing. If one is over-accurate, the actual price is therefore 0.6993%

NBMiner

NBMiner uses fee runs, where there are periods the miner mines for the developers - as you can spot in the below graph by the pulsing:We have also learned that NBMiner has had, and also has, some issues when running low diff, so the deviation gets a bit higher than it would be with a more elevated diff pool. We have done a test with 42.2, and the difference between a low diff and a slightly higher diff pool was -0.41 (-1.37% vs -0.96%)

TeamRedMiner

We haven't collected much data from TeamRedMiner (most of our tests have been on Nvidia cards) - but TeamRedMiner shows an honest hash rate without the inflated reported hash rate some other miners are doing! From the limited data and the graph showing no sign of pulsing like it usually do when there are fee runs, we assume it mines with a continuous fee - but we would like to gather more data before confirming!Trex

T-Rex changed the behavior of the fee going from version 0.24.7 to 0.24.8 - but only when using very low-difficulty pools, as we do in our miner tests. The pulses in the line are when T-Rex does mining for the developers, runs that usually last around 60 seconds.This change in behavior makes the test a bit more complicated to run, as we need to calculate/adjust for the missing fee to get the correct data/numbers we can publish. The graph below shows the time the miner mined the dev fee, comparing an ordinary mining session at Ethermine vs a miner test (low-difficulty pool). This data are collected with T-Rex 0.25.8, but we have seen some behavior from all T-Rex versions from 0.24.8:

USD

USD AUD

AUD CAD

CAD EUR

EUR GBP

GBP

Disclaimer! Hashrate.no utilizes some affiliate and referral links which may generate a small commission. Thanks for supporting us! We also use cookies to track users' input, like, but not limited to power cost, sorting, filters, and prices. We make no warranties of any kind in relation to our content, including but not limited to accuracy and updatedness. Hashrate.no are NOT responsible for any damage; always set your overclock at YOUR own risk and please gain knowledge and do your research! We are not responsible for external links and information that is found there. © Lineo AS 2021-2025

Disclaimer! Hashrate.no utilizes some affiliate and referral links which may generate a small commission. Thanks for supporting us! We also use cookies to track users' input, like, but not limited to power cost, sorting, filters, and prices. We make no warranties of any kind in relation to our content, including but not limited to accuracy and updatedness. Hashrate.no are NOT responsible for any damage; always set your overclock at YOUR own risk and please gain knowledge and do your research! We are not responsible for external links and information that is found there. © Lineo AS 2021-2025